Building better collections

Build revenue more efficiently with AI enhanced services. Unify your finance team to pursue shared goals and monitor customer engagement.

At Mortar we have analysed a range of different financial systems. From the Chief Financial Officer (CFO) and throughout the whole organisation, time prioritisation represents the greatest barrier to strategic decision making and the actions that drive corporate value and revenue.

67% of CFOs cannot focus on strategic priorities because of increasing operational responsibilities and time spent on compliance, controls and costs. EY, The DNA of the CFO

Wasted resources and staff member frustrations are common within a company's income generation and collections team. The average income officer is spending the majority of their time battling with inaccurate information, pursuing and waiting for acknowledgments and ineffectively monitoring accounts and schedules.

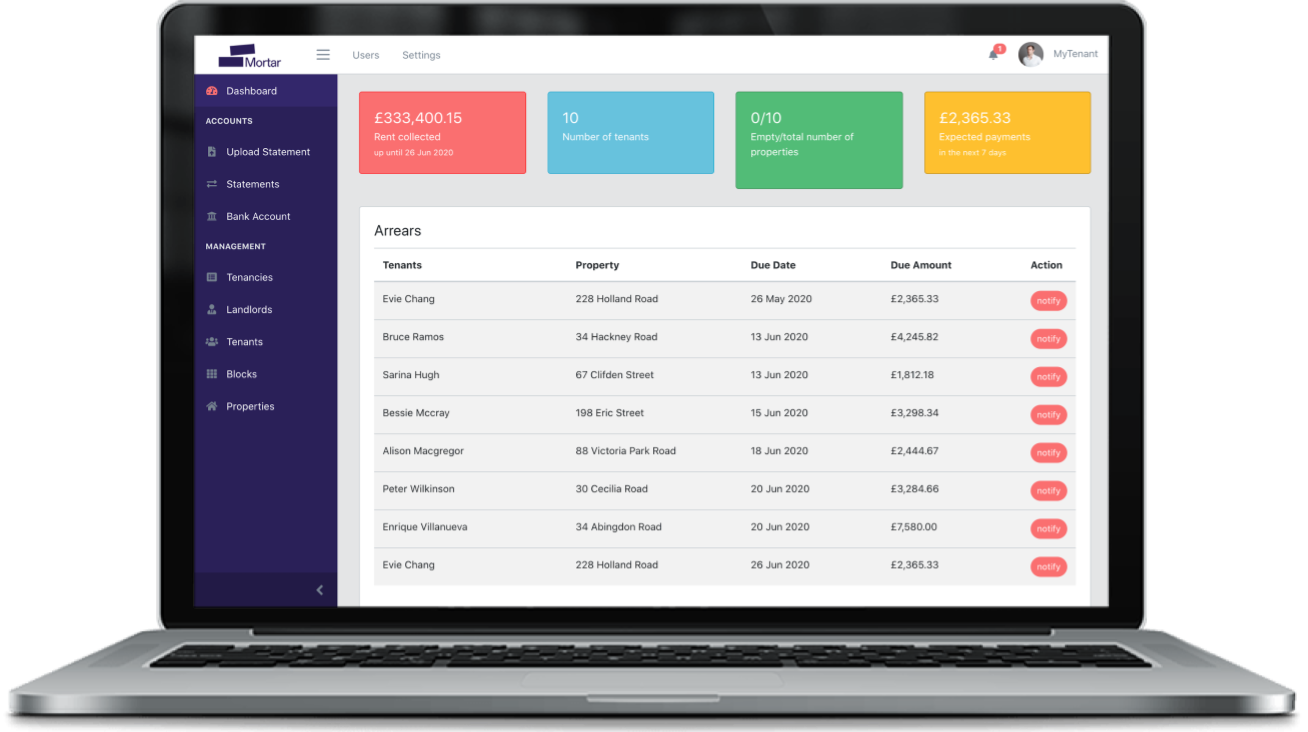

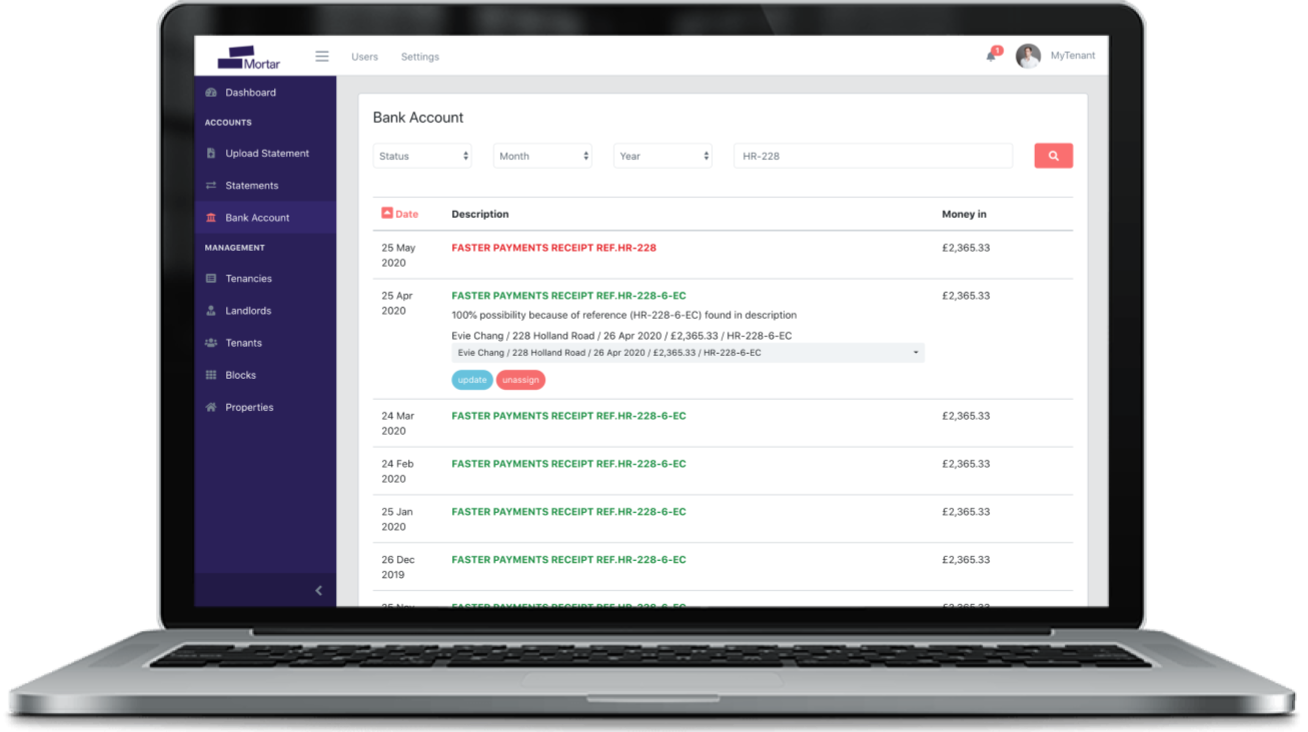

Mortar however provides a single source of unified financial information, enabling the delivery of automated, predictive and proactive account management and collection tools.

Creating Positive Cultures of Forbearance

Your company's culture of forbearance, how it recognises and responds to invoices and arrears, will often undermine and create conflict in the development of customer relationships. For many companies the starting point for customer engagement is too often in response to either a problem or a debt. Achieving positive relationships from such a reactive starting point will not yield positive results or enable customer relationships to develop.

Being on the backfoot generates an enormous excess workload for your income and collections team and restricts finding more effective touchpoints with customers. Cases that need resolving can easily build up, and customers are either waiting for their problems to be dealt with, or are yet to be informed that they have outstanding owings. Everyone in the pipeline ends up in compromised and negative positions.

Mortar's systems are based around an advanced knowledge and understanding of forbearance, our AI engine monitors customer engagement, detecting successful methods and patterns of behaviour, helping your teams to replicate and improve sequences of success. At Mortar we focus on establishing bespoke services and sequencing to help drive your key performance indicators (KPIs). We also provide access to a suite of AI analytics and tooling to help you drive new KPIs, such as mean time to arrears acknowledgement (MTTAA) and mean time to arrears resolution (MTTAR).

A New Generation of User Engagement and Success

Mortar is committed to the advance of consistent, proactive customer engagement and user-led tools for financial and account management.

The CFO agenda goes beyond traditional finance; it involves an innovation and growth imperative, change and transformation, and responding to and making decisions under the headings of uncertainty, performance and efficiency. EY, The New Face of Finance

In corporate service provision we are used to hearing how our outliers and edge customers consume operational resources, energy and time. As a result service quality and frequency of engagement drops for all customers. Digital investment, the implemention of automation and machine learning, is crucial to ensure workloads are manageable, and enables your company's transition to more consumer-led methods of acknowledgement and resolution.

Mortar creates a cohevise data environment (CDE) so you can learn from your business' most compromising events and users, so these events can be more quickly and succesfully identified, supported and resolved in the future. The application of machine learning and automation is essential to start effectively sharing information, creating user-led feedback to enhance service provision and drive success.

Mortar's AI engine powers these transitions and environments, providing intelligent caseworker interfaces for analysing income, introducing predictive and behavioural tools, and highlighting the opportunities for your teams to pursue targeted consumer engagement.